IPO for Deep Tech: Pros & Cons

Could an IPO be the game-changer your deep tech startup needs to reach new heights? An Initial Public Offering (IPO) represents a pivotal moment for any company, especially for deep tech startups.

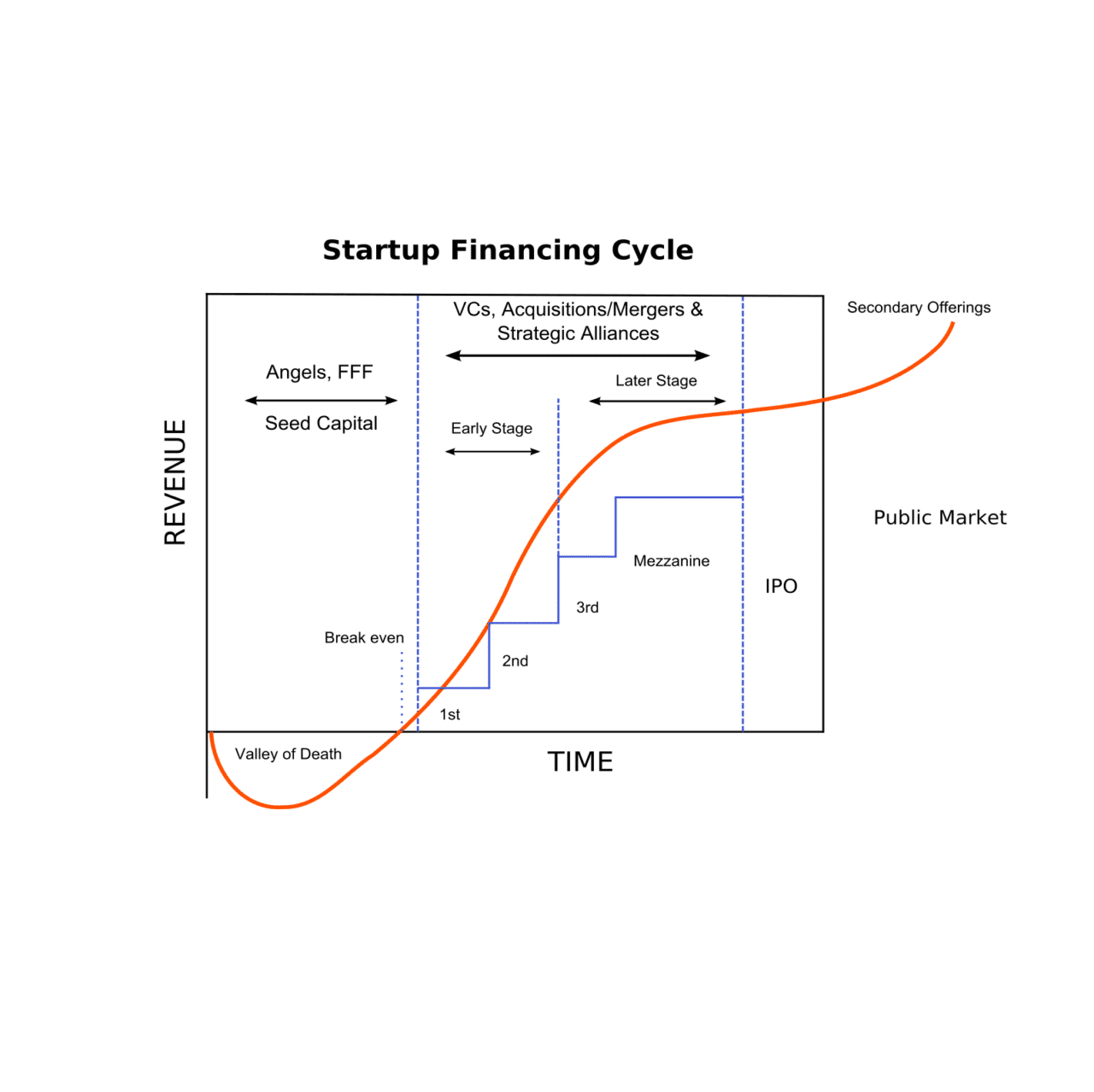

Venture capital investment is needed to raise third-party capital for a promising startup, financing rapid growth. The investment allows either the development of a new product/idea (early stage) or the rapid growth of an existing business (later stage/growth stage). Such investments are considered risky, but the risk of such projects justifies the expectation of super profits, which in the case of venture capital investment exceeds the amount invested many times over. To minimize risks and streamline investments, the process of financing a project through venture capital funds usually is divided into several stages.

This is a very early investment, the first necessary stage to prove new ideas. Seed funding helps start-ups become fully operational. At his stage, the start-up company has a concept, an idea for a product, but no finished product. Investors can be venture capitalists, angel investors, accredited investors, equity crowdfunding investors, revenue-based financing lenders, or government programs.

Investments for the early-stage companies having a pilot version of the product or the first version for demonstration; the product becomes tested. Typically, early-stage companies need funding for marketing and product development expenses.

The company transforms itself into a large organization, showing the features of a public company.

Depending on the type of company, e.g. SaaS or Deep-Tech, both the number of rounds as well as the round designations will be different. A Deep-Tech startup will require substantially more rounds before becoming profitable, as compared to the average SaaS company (hence the preference for many of the VCs to invest in software rather than in hardware).

Image credits: Startup Financing Cycle By Kmuehmel

Could an IPO be the game-changer your deep tech startup needs to reach new heights? An Initial Public Offering (IPO) represents a pivotal moment for any company, especially for deep tech startups.

An article recently published online with the title “Europe needs more scientists in VC to become a deeptech powerhouse – Tech.eu” highlights the fact that the problem deep-tech startups are facing is still not widely understood.

How can you identify and evaluate the deep tech sectors with the highest potential for transformation? Performing an analysis of promising deep tech sectors involves several key steps. Begin by identifying the deep tech sectors with the most potential for transformation.